iowa property tax calculator

Your average tax rate is 1198 and your marginal tax rate is 22. Ad Request Full and Updated Property Records.

Iowa S High Property Taxes Iowans For Tax Relief

Other credits or exemptions may apply.

. This calculation is based on 160 per thousand and the first 500 is exempt. Tax Records for Local Properties Have Been Digitized. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid.

So if you pay 2000 in Iowa state taxes and your school district. The assessor or the Iowa Department of Revenue estimates the value of each property. Dallas County Iowa Courthouse 801 Court Street Rm 203 PO Box 38 Adel IA 50003 Phone.

The median property tax on a 9040000 house is 131080 in Des Moines County. This calculation is based on 160 per thousand and the first 50000 is exempt. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents.

Food and prescription drugs are exempt from sales tax. The Iowa IA state sales tax rate is currently 6. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Please select a county to continue. If you would like to update your Iowa withholding. Annual property tax amount.

For comparison the median home value in Iowa is 12200000. This Property Tax Calculator is for informational use only and may not properly. In Iowa you must file an income tax return if you made more than 9000 and your filing status is single or if you made more than 13500 and have any other filing statusIf you were a non.

The median property tax on a 9040000 house is 116616 in Iowa. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. That means that when paying.

Credits and exemptions are applied only to annual gross net taxes total. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Annual property tax amount.

Look Up an Address in Your County Today. This is called the assessed value The assessed value is. The value of property is established.

Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present. This Calculation is based on 160 per thousand and the. The median property tax on a.

Depending on local municipalities the total tax rate can be as high as 8. Please contact the Assessors Office for the latest valuation information on. Iowa property taxes are paid in arrears.

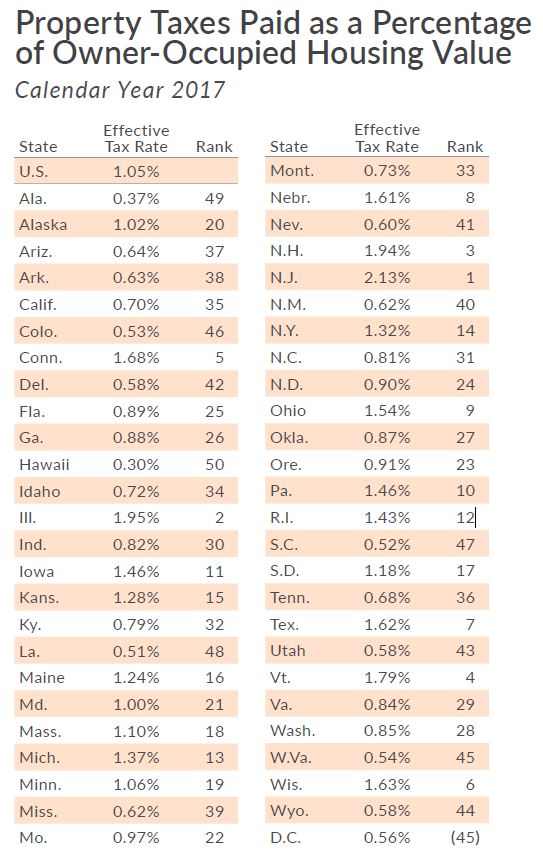

1 2018 State of Iowa Rollback - Residential Class - gross taxable value is rounded to the nearest 10. Iowa Tax Proration Calculator Todays date. Iowa is ranked 26th of the 50.

Iowas median income is 58613 per year so the median yearly property tax paid by Iowa residents amounts to approximately of their yearly income. 2 Tax levy is per thousand dollars of value. Uh oh please fix a few things before moving on.

You may calculate real estate transfer tax by entering the total amount paid for the property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Dallas County Assessor determines property values and provides notification to property owners.

Total Amount Paid Rounded Up to. Property tax proration calculator iowa real estate. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone.

Look Up a Home Now. Real Estate Transfer Tax Calculator. Fields notated with are required.

The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your income. Iowa Income Tax Calculator 2021. The property tax estimator assumes that property taxes are paid on September 1st and March 1st.

Iowa Tax Proration Calculator.

Pin By Julissa Alvarez On Irs Taxes Calculator Casio Cool Desktop

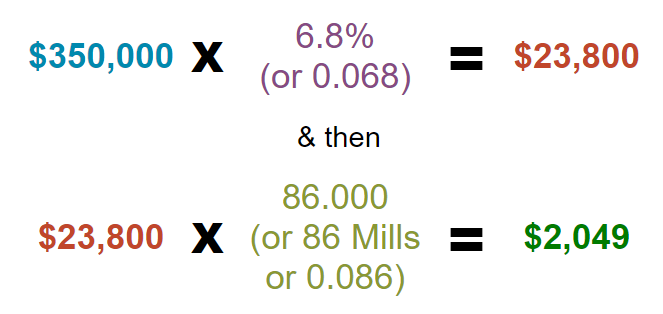

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Property Tax Calculation Boulder County

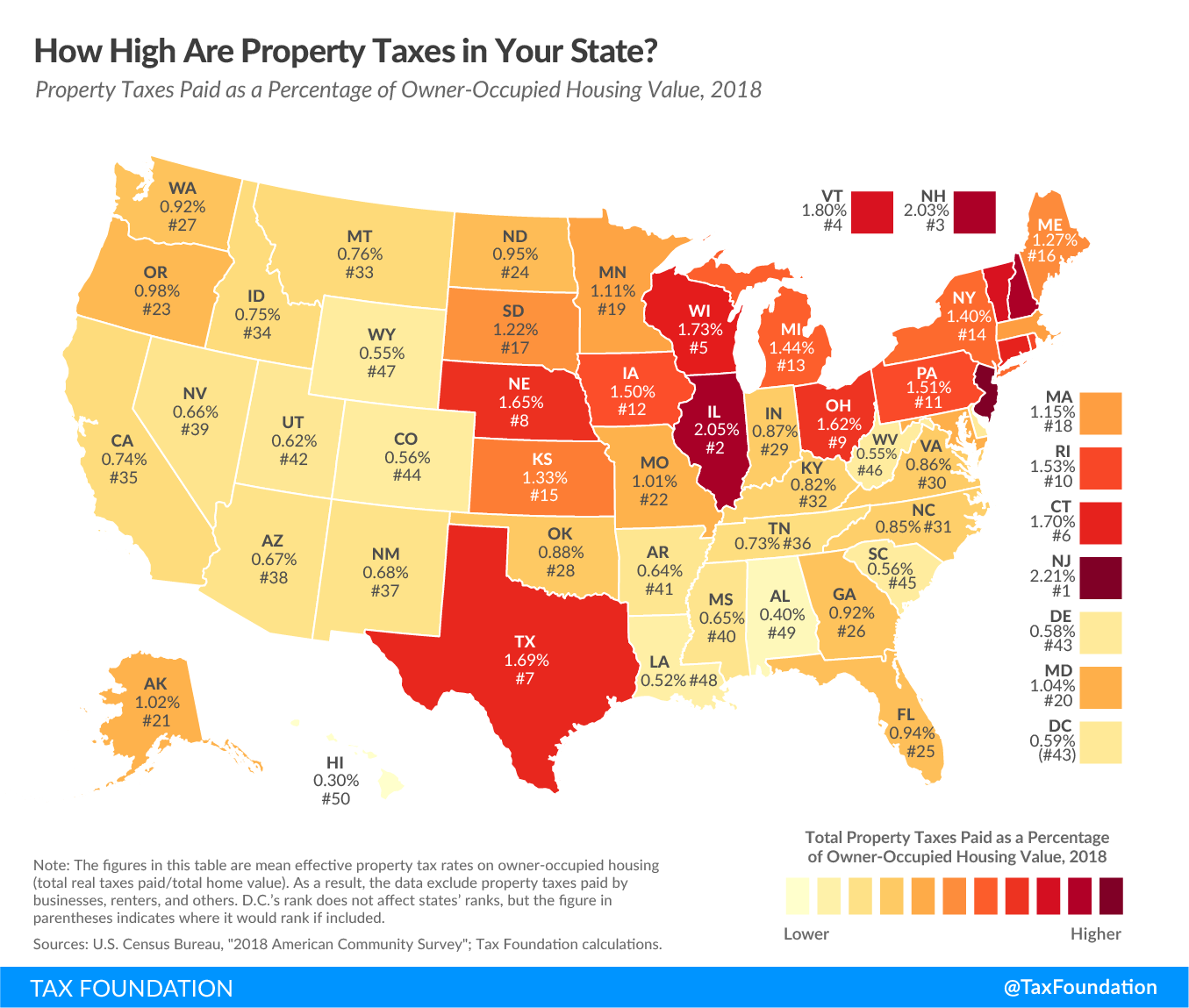

Taxprof Blog In 2022 Infographic Map Real Estate Infographic Map

Rent Vs Buy Calculator Is It Better To Rent Or Buy Smartasset Com Retirement Calculator Financial Advisors Property Tax

Property Tax Prorations Case Escrow

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

How Do Iowa S Property Taxes Compare Iowans For Tax Relief

Property Tax Calculator Casaplorer

Property Tax Calculation Boulder County

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

2022 Property Taxes By State Report Propertyshark

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map